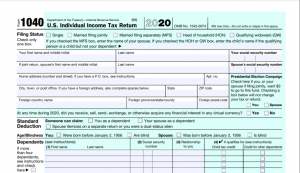

WASHINGTON D.C. (WBAP/KLIF News) – Millions of eligible American families will begin receiving monthly advance child tax credit payments from the IRS, starting July 15th.

WASHINGTON D.C. (WBAP/KLIF News) – Millions of eligible American families will begin receiving monthly advance child tax credit payments from the IRS, starting July 15th.

The payments are up to $300 a month per child under six and $250 for children between the ages of six and 17.

Many parents have already been receiving $2,000 from the IRS for each qualifying child when they receive their annual tax refund. The new law allows parents to receive up to half of the money in advance this year.

The payments are part of the American Rescue Plan COVID-19 relief bill signed into law in March.

The IRS explained the change on it’s website.

“The IRS will pay half the total credit amount in advance monthly payments beginning July 15. You will claim the other half when you file your 2021 income tax return. These changes apply to tax year 2021 only,” said the IRS.

Qualifying parents must meet these stipulations.

- You must have filed your 2019 or 2021 tax return, claiming the credit.

- Provide a valid social security number for children under 18.

- You must have given the IRS information in 2021 to receive the most recent stimulus check.

All qualifying parents will be automatically enrolled unless they’ve opted out by August 2nd and there are some income limits.

Click here for more information and to find out if you are eligible.

Copyright 2021. WBAP/KLIF News. All Rights Reserved.